How To Download Income Tax Paid Challan

How to generate challan form user manual How to pay income tax online following 5 simple steps How to pay income tax online| e-payment of tax 2021| challan 280

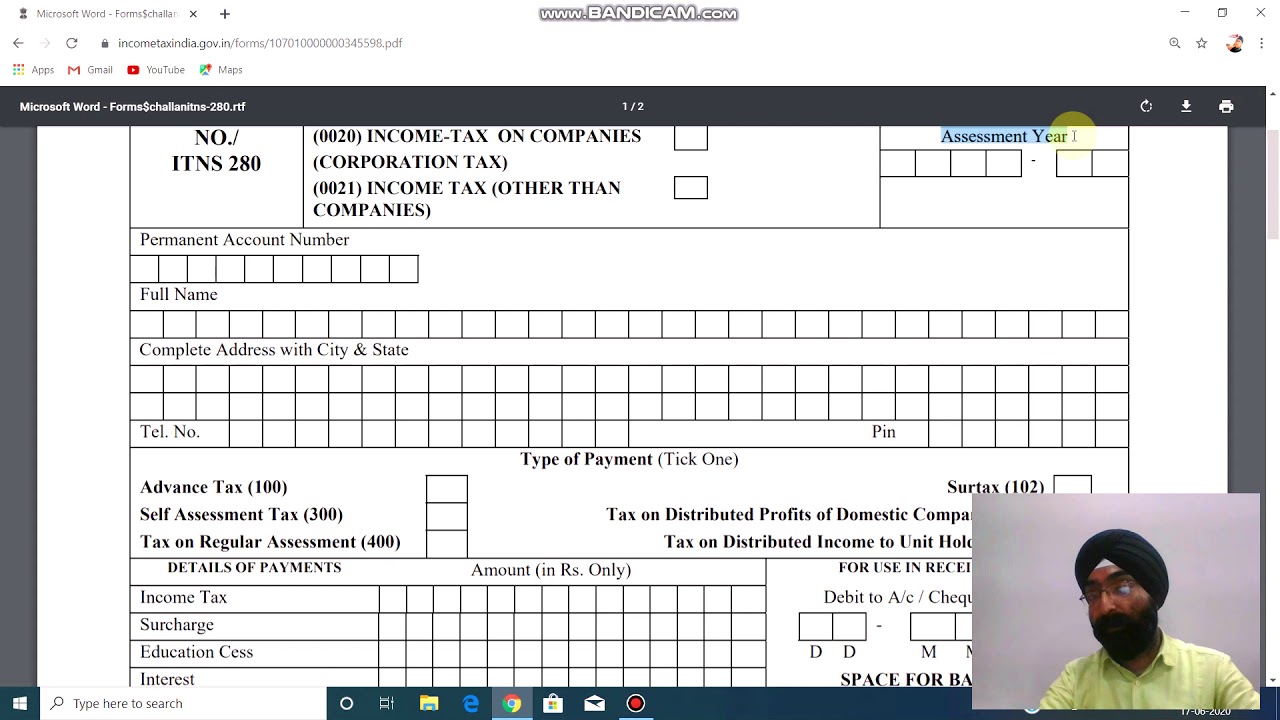

How to Generate Challan Form User Manual | Income Tax Department

E verify income tax returns using hdfc net banking Tds challan 281 excel format fill out and sign printa Income tax

Income tax challan procedure online

Tax payment over the counter user manualChallan tax Post office challan paymentChallan income payment receipt icici itr offline taxes code unable.

Create challan form crn user manual income tax departmentHow to generate challan form user manual How can i pay my income tax onlineHow to pay income tax online.

How to pay income tax online : credit card payment is recommended to

Hdfc returns tax income verify ensure domain select pop pleaseWhat is challan 280: download, types, verifying, income tax challan Create challan form (crn) user manualDownload automated excel based income tax deposit challan 280 fy 2019.

Income tax payment challan (guide)Generate professional tax challan & payment online in mp How to pay income tax challan online through icici bankIncome tax challan fillable form printable forms free online.

How to record income tax payments in tallyprime (payroll)

Automated income tax challan form 280 in excel format up to dateHow to download income tax paid challan from icici bank Challan taxChallan recepit.

Income tax challan payment 2023Challan tax jagoinvestor paying interest reciept Challan tax income excel deposit fy ay automated based itnsOnline income tax payment challans.

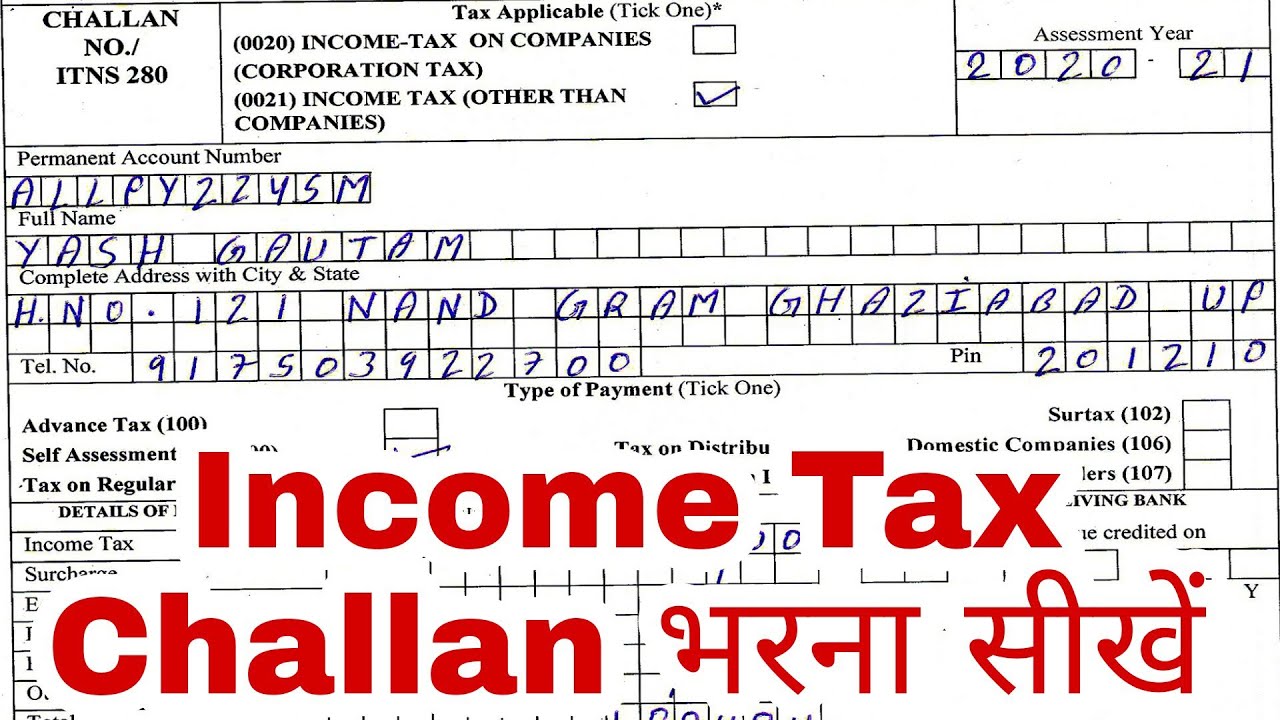

Challan 280: know how to fill income tax challan 280 online/offline

How to download tds challan and make online paymentHow to fill income tax challan 280 offline Challan payrollHow to download income tax paid challan.

Income tax challan status: how to check tds challan status?P tax challan format Tax income payment tds pay online step text guide make videoHow to find income tax paid challan details i check income tax payment.

View challan no. & bsr code from the it portal : help center

.

.