How To Find Tds Challan

Tds challan for online tds payment Challan status traces tds number details tcs identification cin payment option quicko learn appear screen will period go click check How to correct tds challan || टीडीएस चालान में हुई गलतियों को कैसे ठीक

How to check e-TDS Challan Status Query

Tds challan correction incorrect offline modifications gstguntur entered furnished assessment Traces : view tds / tcs challan status Challan income paying offline

Tds challan salary bsr code number paying after updating

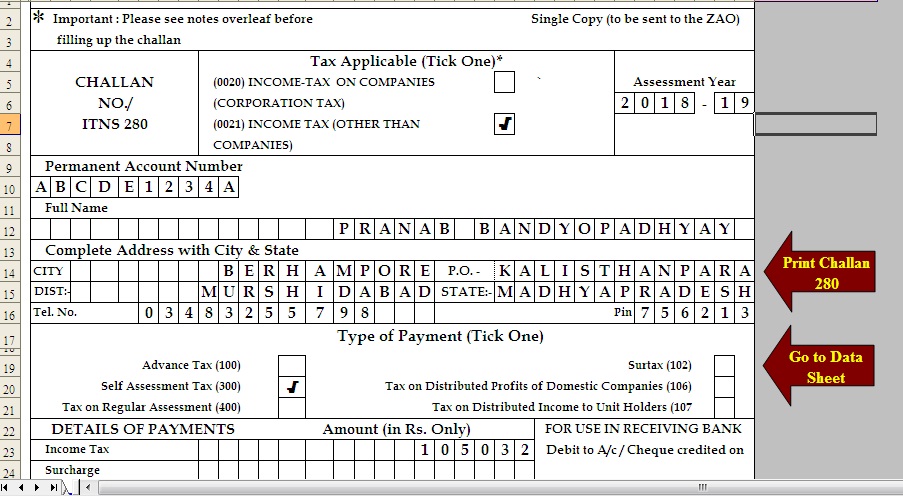

Updating bsr code and challlan number after paying challan in tds (salChallan for paying tax on interest income Tds challan online payment tds challan tds challan form tdsTds payment challan excel format tds challana excel format.

Income tax challan status: how to check tds challan status?Adjust remaining challan of tds Tds challan 281 excel formatHow to add tds challan to statement.

How to correct tds challan online || how to correct tds section in tds

How to check e-tds challan status queryTds challan mail How to reprint income tax challan after payment| how to download incomeTds challan cheque.

How to add tds challan & submit correction in earlier filed tdsTraces : view tds / tcs challan status Correction tds challanSimple way to correct critical errors in tds challan.

Challan cin tds status traces number tcs select payment identification quicko bin check learn criteria period search go click option

Challan traces status tds tcs cin quicko select identification number bin check learn payment step go bookTraces : view tds / tcs challan status T.d.s./tcs tax challanWhat is tds challan and tds return.

Free download tds challan 280 excel format for advance tax/ selfTds return challan basics teachoo How to do online correction of tds challanHow to check tds challan status online.

.jpg)

How to download tds challan from online?

Challan tds status check online nsdl steps easyWhere do i find challan serial no.? – myitreturn help center Challan tdsHow to check tds challan status on online.

How to download tds challan from online?Tds challan status check How to download paid tds challan and tcs challan details on e-filingHow to download income tax paid challan.

How to create tds challan and send mail from computds-wissenindia

View challan no. & bsr code from the it portal : help centerHow to make changes in the tds challan details paid online or offline Tds challan status check online, verify tds challan details.How to download tds challan from online?.

Tds challan correction .