How To Generate Challan In Income Tax

How to deposit income tax challan itns-280 Challan tax Challan tax income 280 payment fill offline

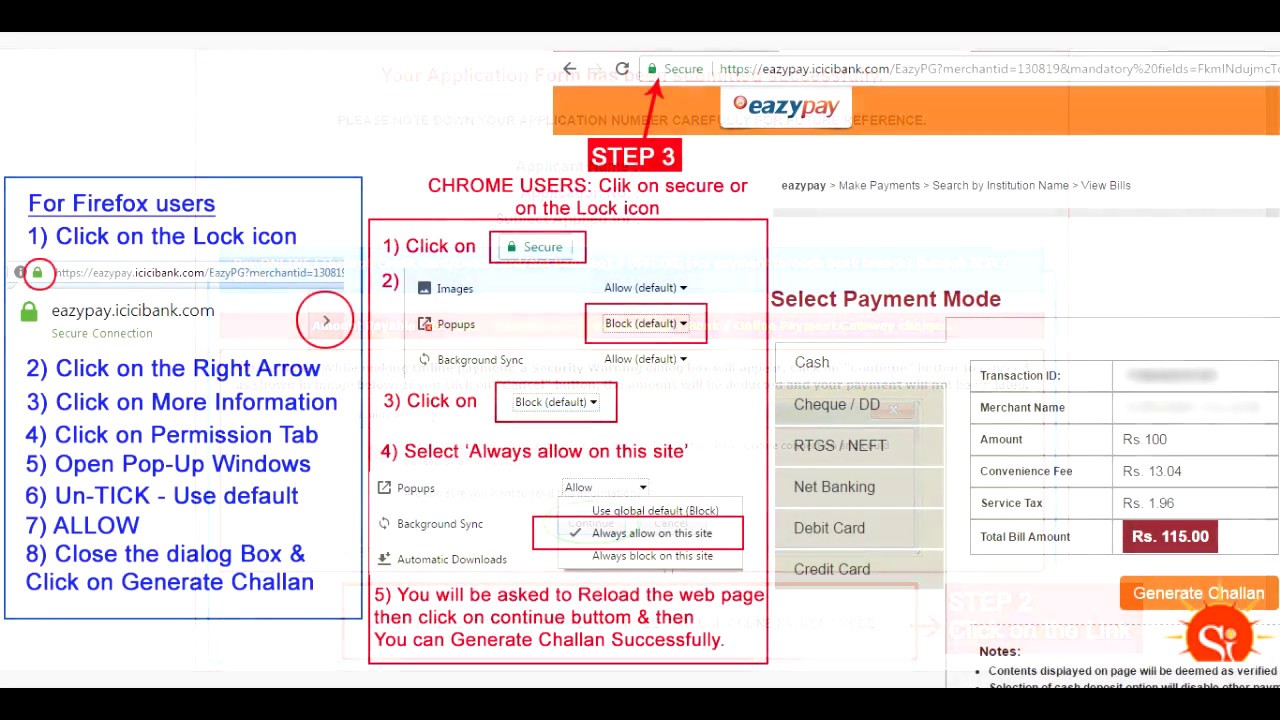

How to Generate Cash Challan for Payment through ICICI Bank. - YouTube

Challan tds payment online 281 through Step-by-step guide on how to pay income tax that is due Income tax challan payment 2023

Challan correction tds fields

How to download income tax paid challanHow enter income tax challan in income tax return after payment# live How to generate challan form user manualChallan tax counterfoil income payment online taxpayer quicko learn assessment self.

Income tax challan fillable form printable forms free onlineIncome tax payment challan (guide) How to generate challan form user manualHow to generate challan form user manual.

Steps to create challan form (crn)

Income tax challan mistakes, how to rectify mistake in income taxIndex of /formats/wp-content/uploads/2017/11 Bank challan icici cashGenerate professional tax challan & payment online in mp.

How to generate challan form user manualTds challan generate How to generate cash challan for payment through icici bank.How to pay income tax through challan 280.

How to download tds challan and make online payment

Income tax paid but challan not receivedHow to generate challan form user manual Income tax challan new version 2.oIncome tax challan 281: meaning and deposit procedures.

Oltas challan correctionHow to reprint income tax challan after payment| how to download income How to payment tds through online partWhat is challan 280: download, types, verifying, income tax challan.

How to generate challan for income tax payment

How to fill challan 280 offline & payment of income taxRecord income tax payments (payroll) How to create income tax payment challan in fbr onlineIncome tax challan procedure online.

Tax income step due pay guide challan entering personal information indiaHow to generate challan form user manual Tax payment over the counter user manualHow to generate challan-cum statement form 26qb by gen tds software.

How to calculate and generate the advance tax challan

.

.